additional tax assessed meaning

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Please help they arent answering the phones again due to the second stimulus checks and bye I never got my first one because my taxes werent processed.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

23 July 2013 at 1015.

. Hi my name is welcome to Just Answer. Tax Assessment means any notice demand assessment deemed assessment including a notice of adjustment of a Tax loss whether revenue or capital in nature claimed by a Brand Company in a manner adversely affecting the Brand Company amended assessment determination return or other document issued by a Tax Authority or lodged with a Tax. Assessment is the statutorily required recording of the tax liability.

Why was additional tax assessed. Examination cases closed as Non-Examined with no additional tax assessed do not meet the definition and criteria of an Audit Reconsideration. Additional assessment is a redetermination of liability for a tax.

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment. Just wait a bit and you will receive a letter explaining the adjustmentThat 290 is just a notice of change. Just sitting in received.

I wonder if I wont get my second because my taxes are still not processed. Approved means they are preparing to send your refund to your bank or directly to you in the mail. After looking it up looks like its under code 290 Additional tax assessed.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due. You understated your income by more that 25 When a taxpayer under reports his or her gross income by more than 25 the three-year statute of limitations is increased to six years.

It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed. Assessment is made by recording the taxpayers name address and tax liability. The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to determine your tax bill.

575 rows Additional tax assessed. It is a further assessment for a tax of the same character previously paid in part. Additional tax as a result of an adjustment to a module which contains a TC 150 transaction.

You can also request a statement of account from the SARS correspondence tab and click on historic IT notices to see your overall balance. It means that your return has passed the initial screening and at least for the moment has been accepted. The 23C date is the Monday on which the recording of assessment and other adjustments are made in summary manner on Form 23C and signed by a Service Center.

What do I owe money for. Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance. It has a cycle code on it does that mean Ill get my tax return.

I was accepted 210 and no change or following messages on Transcript since. Accessed means that the IRS is going through your tax return to make sure that everything is correct. This entry was posted in Tax QA and tagged Audit.

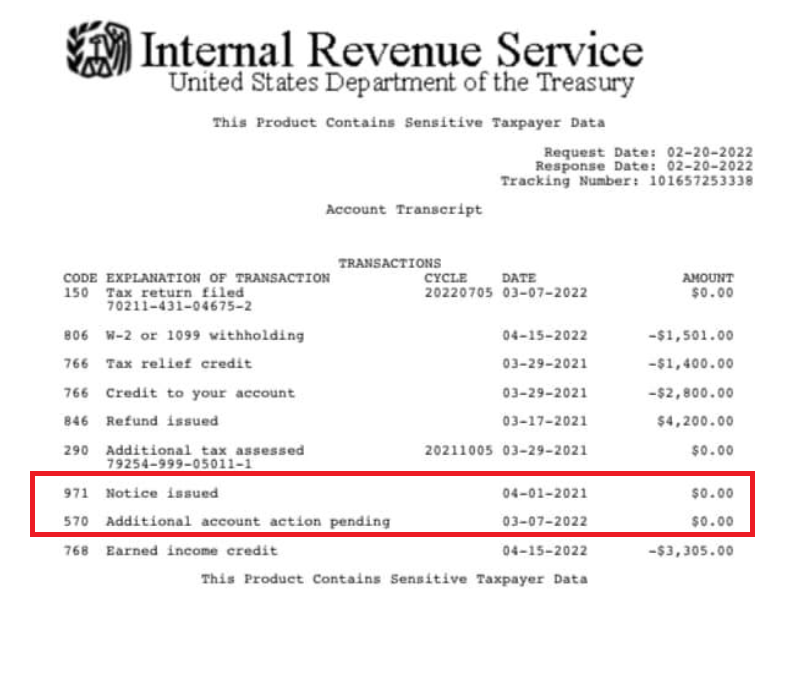

83 rows Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. The following is an example of a case law which defines an additional assessment.

The assessment date is the 23C date. The IRS can assess additional tax at any time if it can prove the taxpayer filed a fraudulent return or failed to file a. February 6 2020 437 PM.

TC 290 with zero amount or TC 29X with a Priority Code 1 will post to a Lfreeze module. If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. They say all good things come to those who wait.

Generates assessment of interest if applicable TC 196. I received my refund already back in April and now this letter states I owe. Received a letter from the IRS stating I owe 66712.

Code 290 Additional Tax Assessed on transcript following filing in Jan.

Your Tax Assessment Vs Property Tax What S The Difference

Your Property Tax Assessment What Does It Mean

Your Tax Assessment Vs Property Tax What S The Difference

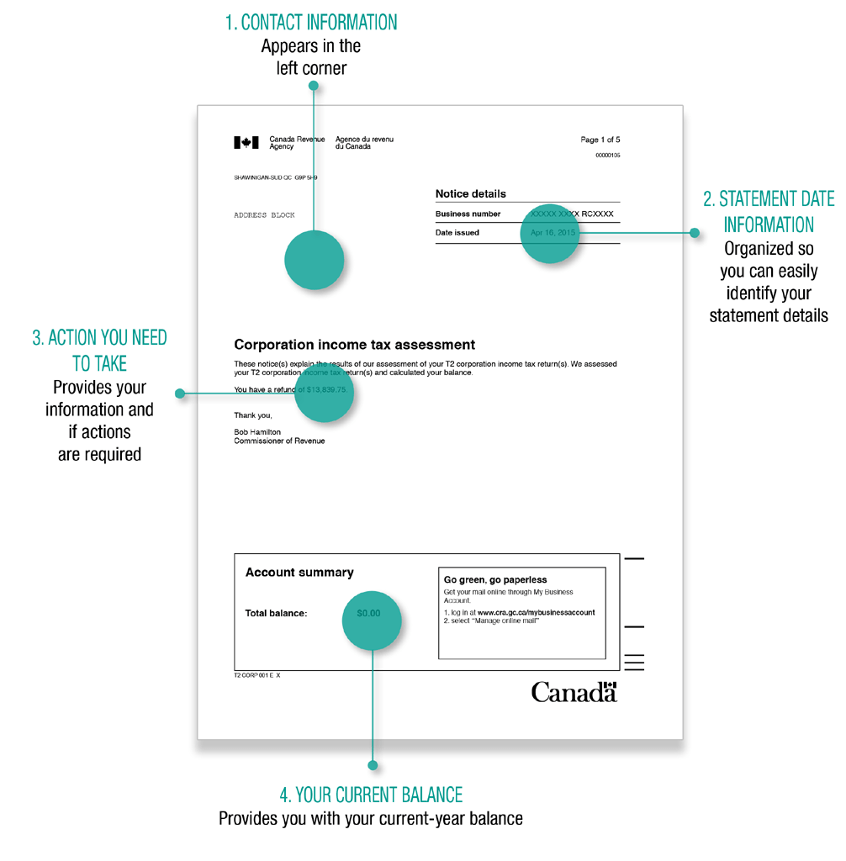

Notice Of Assessment Overview How To Get Cra Audits

How Property Taxes Are Calculated

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Understanding California S Property Taxes

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi